Banking is perhaps one industry where proper reconciliation is of utmost importance. Owing to the enormous volume of transactions going through every minute and different data sources, timely and accurate reconciliation is quite often a challenge. The banking sector experiences a lack of visibility due to many single/ dual-purpose systems, manual reconciliations, and regulatory requirements. To reduce errors, save time, and obtain real-time data and reports, the sector needs a standardized, dynamic solution that can fully automate the reconciliation steps for banks, with clear visibility and granular level audits.

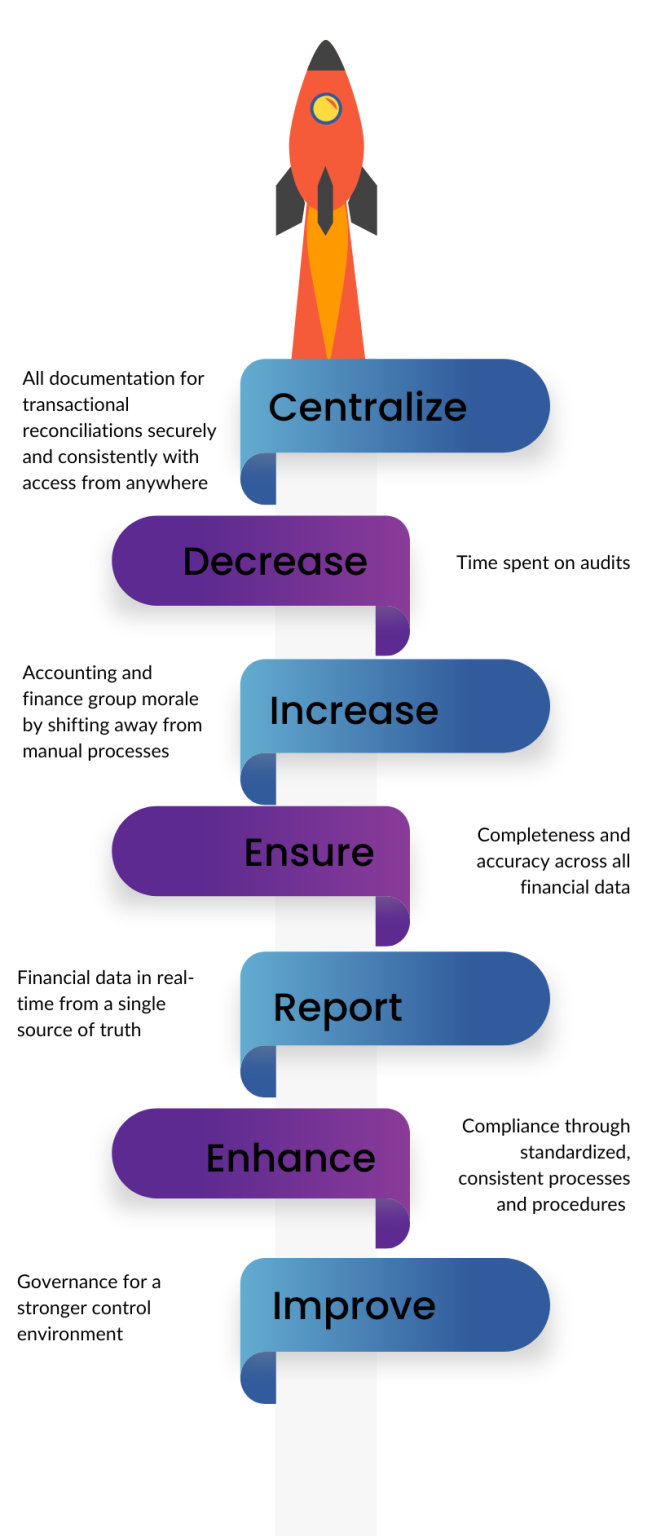

QuikRecon is one such solution. This reconciliation tool is designed specifically for banks that support and allows them to create their own match rules, however complex or simple, to perform reconciliation automatically as soon as the daily data is available. Financial positions and risks can be investigated and resolved in real-time.